The Sweet Spot

Werner C. Duever - May 10, 2023

Has debt got you down? Does it seem like there is no way out of the “pit”? Well, I am here to let you know that there can be a way out, and it is called: The Sweet Spot

Has debt got you down? Does it seem like there is no way out of the “pit”? Well, I am here to let you know that there can be a way out, and it is called: The Sweet Spot.

Getting into debt can be easy and getting out can be even harder!

Getting into debt can be easy. Getting out of debt can be very hard. Ask anyone who has eliminated all their debt. Financial expert, Dave Ramsey, says that you must have “Gazelle Intensity” (you know, the desperate intensity with which the gazelle runs from a cheetah!) to get free from debt.1 It requires great determination and perseverance to break free from debt.

So, let us say you have that determination and you would like to eliminate all your debt, including your mortgage, if you have one. What do you do?

What can I do to get out of debt?

Start first by paying the minimums on what you owe and then using a debt reduction method that best suits you. I like the Debt Avalanche method.2

The Debt Avalanche method starts with you paying off the highest interest debt first. You pull out all your debt statements and find out that the highest interest rate is on your credit card statement (this would be the case for most Canadians). If you can, start by paying more than the minimum on your credit card until it is completely paid off. Next, work on paying off your next highest interest debt – it could be a personal loan or a car loan. Each time you pay off one debt you take the amount you used to pay off the previous debt to pay off the next debt. For example, if you used $400 per month to pay off your credit card, you then add $400 to your loan payment once the credit card debt is gone.

How can I stay out of debt?

In the process of paying down your debt, you open an investment account. I like to use a Tax-Free Savings Account (TFSA) that has mutual or segregated funds in it. A mutual fund is made up of money collected from various investors to invest in securities including stocks, bonds and other assets. Segregated funds on the other hand hold the same securities inside them but in addition they have maturity and death benefit guarantees that mutual funds do not have.3

In the process of paying off your debts you may also be able to build up your TFSA savings. If you invest in more aggressive mutual or segregated funds with higher equity (stocks that are listed on a stock market) your savings may grow quicker. Always make sure you invest within your risk tolerance. Let us say you invest $200 per month for 4 years in a TFSA to purchase units of a mutual fund and earn 6% average annual return. You could accumulate $10,837[4]. This could go a long way to helping you pay off your debt.

The Sweet Spot

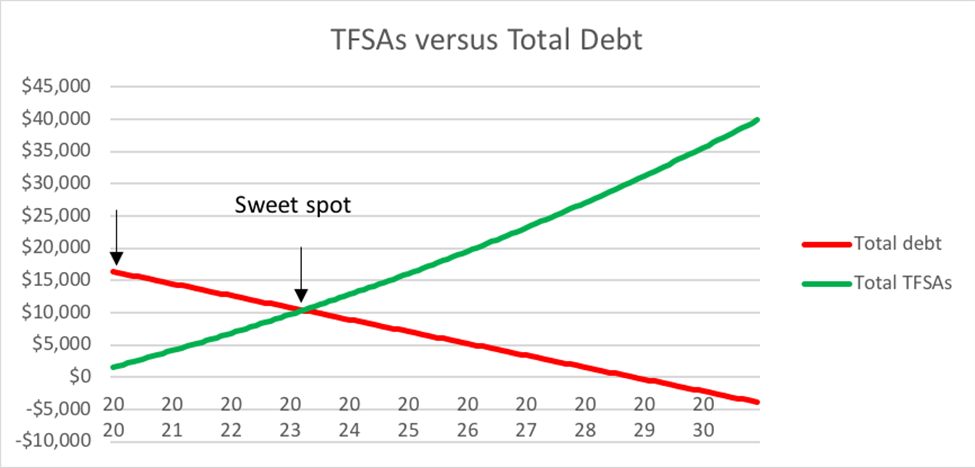

When you simultaneously pay off your debt and increase your TFSA wealth you are working towards achieving your Sweet Spot - the point where what you saved equals what you owe. Some people like to track this in real time on an Excel chart as shown below. Here, we see the hypothetical Sweet Spot, the crossing point where as debt decreases, TFSA income matches and surpasses it.

Note that there are many different methods you can use to help get debt free. Instead of paying off all your debt right away, you may also decide to accelerate your debt payments by using only the gains in your TFSA to pay down your debt more quickly.

If you keep money in your TFSA, instead of paying off all your debt right away, and run into financial difficulty you will not have any reserves for emergencies and thereby have to go into debt again. The point is, if you keep money in your TFSA, you now have more control over your financial situation and in the process have built up an Emergency/Liquidity fund to help in case of an unexpected need.

If you are keen to eliminate debt and want to know more about how you can help grow your wealth, contact me to set up an appointment.

[1] https://www.daveramsey.com/blog/gazelle-intensity-do-you-have-it

[2] https://www.investopedia.com/terms/d/debt-avalanche.asp

[3] https://www.canadalife.com/investing-saving/segregated-funds.html

[4] For illustrative purposes only. The information provided is general in nature and should not be relied upon as a substitute for advice in any specific situation. For specific situations, advice should be obtained from the appropriate legal, accounting, tax or other professional advisors.